Pennsylvania public schools opened this year around Labor Day. Thousands of public schools - elementary, middle and high schools - opened as the law dictates. They will be in session for a minimum of 180 days and a minimum of 990 hours.

- 500 public school districts

- 3287 public schools

- 1,771,395 public school students

- 124,646 public school teachers

- 162 charter schools

(National Center for Education Statistics)

Just one problem. The Commonwealth of Pennsylvania is legally obligated to pass a balanced budget for the 2015 - 16 fiscal year (July 1 - June 30) by June 30th. It is November and Pennsylvania still does not have a budget. When the state does not have an approved budget, there is no state support for school districts, preschools and non-profit social service agencies.

Why can't the legislature pass a budget?

Just one problem. The Commonwealth of Pennsylvania is legally obligated to pass a balanced budget for the 2015 - 16 fiscal year (July 1 - June 30) by June 30th. It is November and Pennsylvania still does not have a budget. When the state does not have an approved budget, there is no state support for school districts, preschools and non-profit social service agencies.

Why can't the legislature pass a budget?

Governor Tom Wolf was elected in November of 2014. He won a landslide election over Tom Corbett, the incumbent governor. Wolf, a Democrat, had 54.9% of the popular vote to Corbett's 45.1%. One can consider his victory a mandate. Wolf ran on the following issues (York Daily Record):

- Address the public employees pension debt;

- Raise the minimum wage;

- Lower the corporate net income tax while closing the "Delaware Loophole";

- Bring PA's job creation rate to the top of the rankings;

- Provide universal Pre-K access;

- Lower school property taxes;

- Enact 5% extraction tax on natural gas drilling;

- Expand Medicaid; and

- Restore $1 billion in education cuts.

This is not a radical agenda. It indicates a desire to support children and families (education, preschools, teacher pensions, Medicaid expansion). It also addresses tax reform at the corporate and local level. So what's the problem?

Politics, Money, Beliefs and the Dirty Little Secret.

Politics, Money, Beliefs and the Dirty Little Secret.

Politics (aka Power)

|

| 2014 PA Governor's Election |

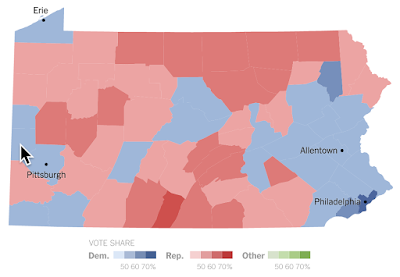

What was he getting at? Basically the two major population centers in the state are overwhelmingly Democrat. Outside of those centers, there is a very large, rural area that is conservative, Republican, anti-tax and anti-government.

Note the New York Times map above. This shows how the state voted by district in the 2014 Governor's election. Since Philadelphia and Pittsburgh are the most populous areas of the state, they often determine statewide elections such as Governor or President. Pennsylvania voted for Obama (D) in 2008 and 2012 and elected Tom Wolf (D) Governor in 2014.

However when we elect our legislature by district, the opposite is true. Like the federal government, the Pennsylvania legislature has both a House of Representatives and a Senate.

The Pennsylvania House of Representatives has 203 members, elected for two-year terms from single member districts. Currently the House has 119 Republicans (59%) and 84 Democrats (41%).

The Pennsylvania Senate has 50 members who are elected for four-year terms by district. Currently the Senate has 30 Republicans (60%) and 20 Democrats (40%).

A Republican legislature and a Democrat Governor. That's called gridlock. This is nothing new for Pennsylvania.

Yet the new Governor, Tom Wolf, decided that he would take the legislature on and work for change. And the legislature decided to take the Governor on. Both sides dug in. During the budget impasse, the Republicans offered a stop-gap measure to fund the budget in the short term until agreement could be reached. The Governor vetoed the idea. He is attempting to hold the legislators accountable for the budget and is forcing the impasse.

Democrats (located mainly in urban areas) want:

- Better education funding (we have one of the most inequitable K-12 funding formulas in America, and the highest public university tuitions in America);

- Tax revenue from the fracking industry (at a rate that every other state currently has in place);

- Universal Pre-K and Improved Child Healthcare (the state currently ranks low on overall child well being);

- Tax reform: a move from local property taxes towards sales and income taxes that would create more equitable funding for education; and

- Better healthcare for all by expanding Medicaid: the last Republican governor did not access available federal funds to expand coverage in the state.

Republicans (located mainly in suburbs and rural areas) want to:

- Lower taxes - corporate, individual, property;

- Privatize the state run liquor industry (this has been a fight that has gone on for decades); and

- Eliminate public service employee pensions (teachers and government workers).

Urban districts want services, rural districts want to be left alone. As Carville would say, Philadelphia and Pittsburgh want help educating their children and Alabama wants the government to bug out.

Looking through the filter of politics our elected Legislature and Governor have a fundamental difference in philosophy, beliefs and experiences. And since the methodology for electing Executives (statewide) versus Representatives (district wide) are biased in different directions, we end up with gridlock. Thus nothing ever changes.

Money and Core Beliefs

The Democrats and Liquor Store Privatization

In Pennsylvania, you cannot buy beer, wine or liquor in a supermarket. You can only buy beer at beer distributors or bars. Wine and liquor must be bought at state owned liquor stores. For those who have traveled out of state you understand how bizarre this is. If you go to Maryland, you can buy beer and wine in grocery stores. You can buy liquor at any number of privately owned stores. You can go to a Total Wine store which is like a Costco for alcohol, get huge discounts and have an extraordinary selection. If you go to Virginia, you will find a hybrid of the PA and MD models, where you can buy wine and beer in supermarkets, but have to buy liquor in state owned ABC stores.

So why does PA hang on to this antiquated model? The Democrats argue that they make more money this way. I've spent a lot of time looking into the PLCB (Pennsylvania Liquor Control Board) revenues and it appears they do. Between liquor taxes, sales tax and profit the PLCB puts $500,000,000 into the state budget which is about three times as much as VA or MD. Note however, that the total Pennsylvania budget is $84 billion, thus liquor revenue represents less than 1% of the budget.

After the issue of money, the second concern is one pertaining to labor unions and state workers. There are over 5000 people that are employed by the PLCB. They are unionized. Thus they represent a substantial lobby that appeals to the Democrats (who tend to be pro-union). Their union spent over $1 million in 2014 on advertising, lobbying and campaign contributions to stop the privatizing of the PA liquor system.

As one can guess, the Republicans want the PLCB to become a free market enterprise, to get rid of the unions, the state employees and the pensions they earn. The problem is that the Republicans will not suggest a way to replace the loss of income if the stores are privatized.

The bottom line is that the Democrats in Pennsylvania are for the state liquor system because it generates revenue and it supports a 5000 person workforce at a living wage. The PLCB system began after Prohibition in 1933. It represents a modern trend of state governments to use "sin taxes" to balance budgets. The taxing of liquor, marijuana (Colorado), gambling, lotteries, prostitution (Nevada) and cigarettes have become substantial revenue sources for states. In some cases, the states go into the business, as they have in liquor and lotteries in Pennsylvania. In other cases they just tax them at high rates.

I would suggest that the Democrats are not wedded to the PLCB, but they are desperate for the revenue it generates. They want to apply this revenue to education, healthcare, the elderly, PreK access, etc. And the Republican's want to close it down. This is about money... and a belief as to government's place in our society. Thus it is part of the budget discussion.

I wrote about this in a blogpost entitled 2001 - The Beginning of the End. The Republicans in the legislature want to dismantle the defined benefit pension program for state and public school employees and move new employees to a defined contribution program (401K). (Note. In the spirit of full disclosure, I worked for 35 years in public education and am a retired educator who receives a pension from PSERS.)

PSERS (Public School Employees Retirement System) began in 1917 when the state became seriously involved in creating a public education system for all students. The goal of PSERS and SERS (State Employees Retirement System) was to provide a pension for those people who serve in the public sector. This type of pension is common for teachers, judges, state police, veterans, legislators, government workers and anyone who works for a non-profit government entity.

The tension regarding public employees in general and pensions in particular pertains to employee quality and limited financial resources.

Citizens expect government workers, particularly in education, justice, public safety, administration and finance to be of a high quality. They are entrusted with the various enterprises that government engages in - education, public safety, roads, infrastructure and regulation of industry - on the public behalf. They should be well educated, experienced and professional in the way they conduct business.

Workers in the public domain are paid through taxes collected from citizens. Without taxes, there would be no public services. However, since taxes are collected centrally and are deducted from everyones pay, they effect individual and family disposable income. Thus there is an inherent tension between the value of public services and the cost of public services. Public employees are compensated below market value for their level of education, certification and expertise relative to their counterparts in the private sector. The concept of a defined benefit pension was put in place as an incentive to draw quality professionals to a lifetime of public service.

I believe it is safe to say that in social democracies such as those in Scandinavia, it is a shared value of most citizens to pay taxes for these shared expenses. I believe it is also fair to say that at this time in the United States, it is a shared value of many citizens that whatever government does would be accomplished more efficiently in the private sector. Socialism versus Capitalism. Democrats versus Republicans.

As I reported in the blogpost mentioned above, PSERS and SERS were funded at the 125% level in 2000. The pension fund had worked perfectly for 80 years. In 2001, a Republican governor and Republican legislature changed the pension law. They increased the benefit for retirees and decreased the state contribution to the fund. This goes against every best business practice, against every actuarial assumption and ethically was inappropriate. What they did was mortgage the future to cut taxes in the present. And that's exactly what happened. With the help of two stock market recessions, Governor Tom Ridge and the legislature ultimately bankrupted the pension. Today it is funded at the 59% level. And it is costing both local school districts and the state huge amounts of money to make it solvent. This had nothing to do with employees, workers or their unions. The blame can be placed directly on elected officials, Republican officials.

Now they want to eliminate the pension entirely. They are being accused of wanting to dismantle public education in the process. This is why the pension discussion is a big part of the current budget impasse. As stated above this is about money... and differing beliefs about government's place in our society.

The Dirty Little Secret

So the budget impasse is going into its fifth month. And I am suggesting this is about money, power and very different beliefs about the purpose of government. They battle, posture, argue and diminish our belief in government. And they get nowhere. This we know.

Here are some excerpts from an article in the Associated Press - Woe spreads in Pennsylvania's 4-month budget standoff.

State-subsidized pre-kindergarten programs are shutting down, domestic violence shelters are closing their doors and Pennsylvania's school districts are begging for more time to pay their bills — all because of a four-month budget stalemate that shows no signs of ending.

County governments and local school boards waiting on billions in state aid are burning through loans and emptying reserves. Some social services organizations are shuttering programs and laying off hundreds of workers who care for the state's most vulnerable populations.

Two shelters for domestic violence victims closed their doors to new arrivals Friday, citing the lack of state aid. Last Monday, a woman in a shelter for domestic violence survivors tried to kill herself after she missed an appointment with a therapist. The shelter had halted its transportation services to save gas money.

A state-subsidized pre-K program at Riverview Children's Center in the Pittsburgh suburb of Verona closed down, too...

A Pittsburgh-area school district that is one of Pennsylvania's poorest, McKeesport, has left teaching positions unfilled, ballooning elementary class sizes, and canceled tutoring and some high school electives. Bigger cuts — athletics and pre-K — may be in store, Superintendent Rula Skezas said.Schools, shelters, Pre-K programs, mental health facilities, etc. are not getting their usual state subsidies.

Under a 2009 court ruling, state employees can be paid and kept on the job, meaning that no state functions — such as prisons, highway patrols, state parks or driver license centers — are shut down, although money for expenses from travel to toilet paper is scarce and utilities and other contractors are going unpaid.

Other provisions in federal or state law allow Medicaid, unemployment compensation and debt payments to be made.Yet the government is still functioning. Governors, Representatives, judges, administrators, managers and workers are all getting paid. State government activities are going on as usual. Taxes are collected and expenditures are made. It's just kids, schools and non-profit agencies that help the less fortunate that receive no money. Read that last sentence again.

But it's worse than we think. Is it all schools?

Remember that school district revenues come from five main sources: local property taxes, state funding, federal funding, other financing (loans or grants) and the fund balance. Let's look at two districts at either end of the spectrum - Fox Chapel and Wilkinsburg.

|

| In Fox Chapel, local property taxes generate 76.2% of the total budget, state revenues are 14.89% and the fund balance is $6.7 million. |

|

| In Wilkinsburg, local property taxes generate 50% of the total budget, state revenues are 40% and the fund balance is $0. |

The effect of the impasse on School Districts is not equal.

- Fox Chapel gets 14.89% of its revenue from the state and has a $6 million dollar fund balance to access during the impasse.

- Wilkinsburg gets 40% of its revenue from the state and has no fund balance to access during the impasse.

This is typical for poor districts with high poverty. In Allegheny County this would include the Pittsburgh Public Schools, Clairton SD, McKeesport SD, Sto-Rox SD, Penn Hills SD and Woodland Hills SD. Poorer school districts must obtain bank loans to meet payroll and stay open. They close programs. They pay loan interest to the banks. And they stop making their payments to public Charter Schools.

"With the state budget impasse heading into its third month, at least 17 school districts and two intermediate units have had to borrow $346 million to keep operating, Pennsylvania Auditor General Eugene DePasquale said Tuesday."So the poorer districts have larger class sizes, are not hiring to fill empty positions and eliminate programming, field trips, etc. The wealthier schools are less reliant on state funding and have their fund balance to cover the gap until the budget is passed.

|

| Pennsylvania's spending during budget impasse hits $27 billion |

Not to worry though. The Legislature and Governor will soon pass a budget... when the middle class white school districts start to run out of money. You can bet on it.

Happy Thanksgiving...